knoxville tn sales tax rate 2019

Average Sales Tax With Local. 2020 rates included for use while preparing your income tax deduction.

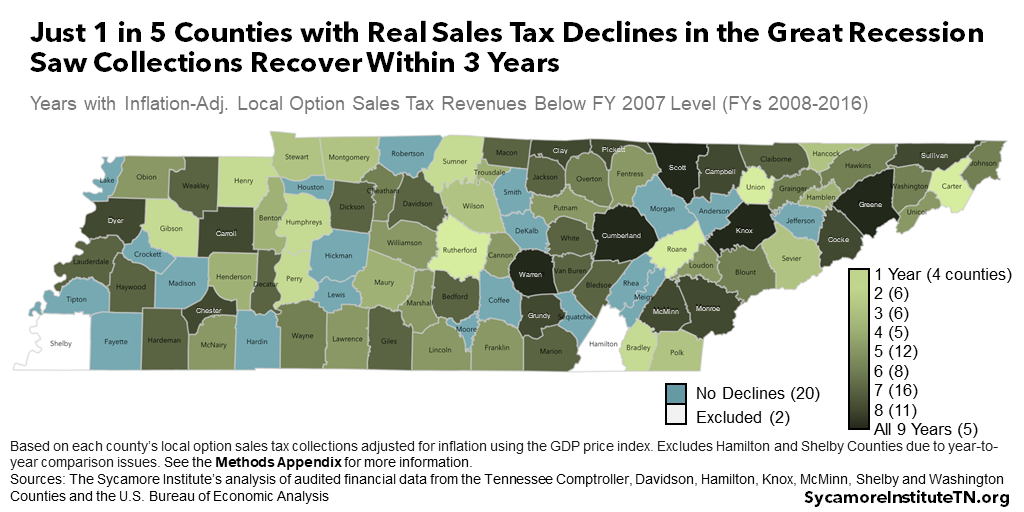

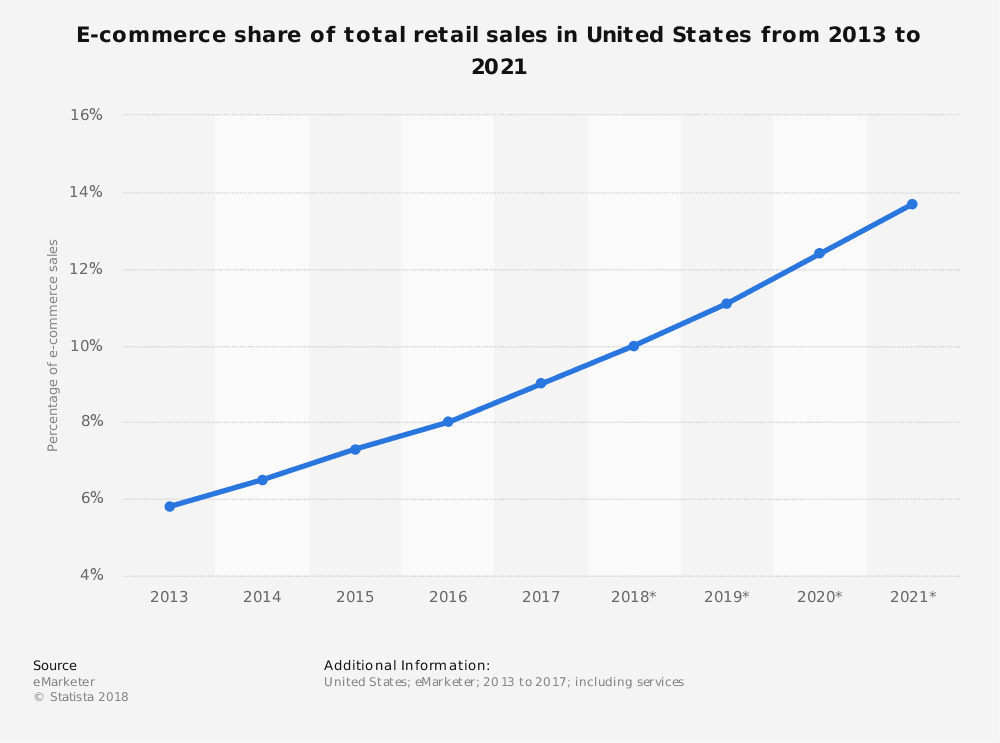

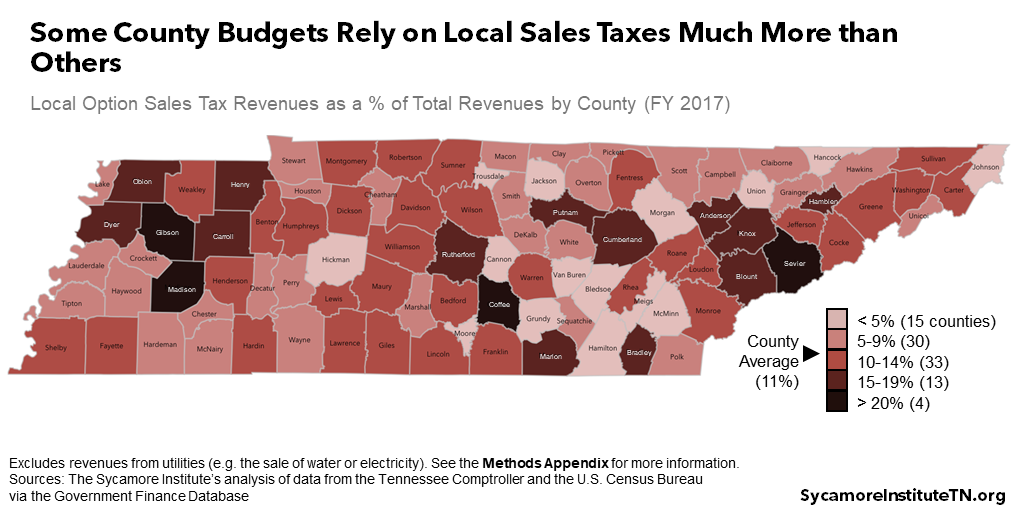

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Tax Sale 10 Properties PDF Summary of Tax Sale Process and General Information Tax sale dates are determined by court proceedings and will be listed accordingly.

. The minimum combined 2022 sales tax rate for Knox County Tennessee is. 67-6- at 45. The 925 sales tax rate in Knoxville consists of 7 Tennessee state sales tax and 225 Knox County sales tax.

2022 List of Tennessee Local Sales Tax Rates. Aviation fuel actually used in the Charges of 15 or less are exempt operation of aircraft motors is taxed from tax. Maryville TN Sales Tax Rate.

Knox County collects a 225 local sales tax the maximum local sales tax. The 45 sales and use tax 103f 67-6-226. The Knox County Sales Tax is collected by the merchant on all qualifying sales made within Knox County.

Last item for navigation. The Knox County sales tax rate is. Johnson City TN 37601 Knoxville TN 37914 423 854-5321 865 594-6100.

120th of 001 per gallon if the 001 special tax has been paid then 119th of the 001 per gallon of the special privilege tax may be credited on a monthly return or alternatively refunded. Did South Dakota v. The minimum combined 2022 sales tax rate for Knoxville Illinois is.

Ad Calculate sales tax automatically with an Avalara plugin for the ecommerce system you use. Property taxes can be paid by mail to PO. Tennessees sales tax rates for commonly exempted items are as follows.

The sales tax is comprised of two parts a state portion and a local portion. The sales tax rate on. Wayfair Inc affect Tennessee.

Tennessee has a 7 sales tax and Knox County collects an additional 275 so the minimum sales tax rate in Knox County is 975 not including any city or special district taxes. State Capitol Nashville TN 37243-9034 6157412775 To Report Fraud Waste Abuse. This table shows the total sales tax rates for all cities and towns in Knox County including all local taxes.

Wayfair Inc affect Illinois. Did South Dakota v. Rates include state county and city taxes.

925 7 state 225 local City Property Tax Rate. Please click on the links to the left for more information. You can print a 925 sales tax table hereFor tax rates in other cities see Puerto Rico sales taxes by city and county.

The latest sales tax rate for Knoxville TN. The general state tax rate is 7. The Tennessee sales tax rate is currently.

For tax rates in other cities see Tennessee sales taxes by city and county. The local tax rate varies by county andor city. You can print a 925 sales tax table here.

Lebanon TN Sales Tax Rate. The TN sales tax applicable to the sale of cars boats and real estate sales may also vary by jurisdiction. The 2018 United States Supreme Court decision in South Dakota v.

Spend less time on tax compliance with an Avalara AvaTax plug in for your shopping cart. The current total local sales tax rate in Knoxville TN is 9250. Ad Automate Standardize Taxability on Sales and Purchase Transactions.

Johnson City 423 854-5321. The Tennessee state sales tax rate is currently. The latest sales tax rate for Knox County TN.

La Vergne TN Sales Tax Rate. 2019 Tennessee Property Tax Rates. 2020 rates included for use while preparing your income tax deduction.

Average local rates rose the most in Florida jumping the state from the 28th highest combined rate to the 22nd highest. This is the total of state county and city sales tax rates. Tennessee Taxpayer Access Point TNTAP.

There are approximately 1100 people living in the Knoxville area. There is no applicable city tax or special tax. The 925 sales tax rate in Knoxville consists of 7 Puerto Rico state sales tax and 225 Knox County sales taxThere is no applicable city tax or special tax.

Lowest sales tax 85 Highest sales tax 975 Tennessee Sales Tax. The Illinois sales tax rate is currently. This rate includes any state county city and local sales taxes.

This is the total of state and county sales tax rates. Knoxville TN Sales Tax Rate. Look up 2022 sales tax rates for Knoxville Texas and surrounding areas.

What is the sales tax rate in Knox County. The Knoxville sales tax rate is. The December 2020 total local sales tax rate was also 9.

2020 rates included for use while preparing your income tax deduction. Knoxville TN 37902. The December 2020 total local sales tax rate was also 9250.

67-6-228 state and local sales tax rates. This is the total of state county and city sales tax rates. County City SpecialSchoolDistrict CountyRate CityRate SpecialSchoolDistrictRate Total Jurisdiction TaxYear.

The sales tax is Tennessees principal source of state tax revenue accounting for approximately 60 of all tax collections. What is the sales tax rate in Knoxville Illinois. The latest sales tax rates for cities in Tennessee TN state.

Box 15001 Knoxville TN 37901-5001 or in person at the downtown Property Tax Office. Integrate Vertex seamlessly to the systems you already use. Are charged at a higher sales tax rate.

Tax rates are provided by Avalara and updated monthly. This rate includes any state county city and local sales taxes. Tennessee Sales and Use Tax County and City Local Tax Rates County City Local Tax Rate Effective Date Situs FIPS Code County City Local Tax Rate Effective Date Situs FIPS Code Anderson 275.

The minimum combined 2022 sales tax rate for Knoxville Tennessee is. Knoxville TN Sales Tax Rate. The Knoxville sales tax rate is.

Property tax rates. The Knoxville Pennsylvania sales tax rate of 6 applies in the zip code 16928. Remember that zip code boundaries dont always match up with political boundaries like Knoxville or Tioga County so you shouldnt always rely on something as imprecise as zip codes to determine.

05 lower than the maximum sales tax in TN. Tennessee has state sales tax of 7 and allows local governments to collect a local option sales tax of up to 275. What is the sales tax rate in Knoxville Tennessee.

At that time the Mayor anticipated with countywide reappraisals and a new forthcoming certified tax rate that the final City tax rate would actually. On April 22 2022 Mayor Indya Kincannon proposed a 50-cent increase in Knoxvilles property tax rate to generate new revenue needed to maintain core services and support first responders. The County sales tax rate is.

Submit a report online here or call the toll. There are a total of 307 local tax jurisdictions across the state. The County sales tax rate is.

Current Sales Tax Rate. The Knox County Tennessee sales tax is 925 consisting of 700 Tennessee state sales tax and 225 Knox County local sales taxesThe local sales tax consists of a 225 county sales tax. The five states with the highest average local sales tax rates are Alabama 514 percent Louisiana 500 percent Colorado 473 percent New York 449 percent and Oklahoma 442 percent.

Year Specific Tax Rate Elasticities And Internet Penetration Rates Over Download Scientific Diagram

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Taxes Do Residents Pay Income Tax H R Block

Tennessee Sales Tax Rates By City County 2022

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Tennessee Car Sales Tax Everything You Need To Know

Tennessee Tax Rates Rankings Tn State Taxes Tax Foundation

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

3 Things You Need To Know About Internet Sales Tax After Wayfair Red Stag Fulfillment

Tennessee Sales Tax And Other Fees Motor Vehicle County Clerk Knox County Tennessee Government

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue

Which Tennessee Counties Might See The Largest Drop In Sales Tax Revenue